Cryptocurrency trading is a rewarding investment when done right. But, studies indicate that this trading sphere is unforgiving to less skilled traders. For instance, 95% of new traders focusing on Bitcoin lose money instead of making a profit.

Furthermore, the studies reveal that most beginners who make a loss commit similar trading mistakes. They rely on self-proclaimed professionals and lack a detailed trading roadmap to guide them. The list of blunders that new crypto traders commit is endless.

Therefore, if you are starting and do not wish to be counted among those who get spit out from this sphere, here are common blunders to watch out for. Avoiding them will help you make more profits than losses.

7 Mistakes to avoid when doing Cryptocurrency Trading

1. Trading without practice

Crypto trading is an art. It has ground rules to be followed, market trends to watch out for, and pitfalls to avoid. That’s why trading platforms have a demo account to bring you up to speed before getting into actual money trading.

No matter how prepared you feel, never ignore using a demo account. It gives a platform to put your trading knowledge to the test. If you make several losses in the trial, it would be prudent to refresh your trading knowledge.

However, if your mock trades are always on point, you can confidently start trading with real money.

2. Ignoring the stop loss function

Surprise economic challenges, a trending crypto rumor, and other unforeseen issues can send the prices of cryptocurrencies to the wrong side. When this happens, your speculation will go south so quickly. This is where the stop loss order comes in.

It lets you exit a position when prices fall to a pre-determined point. As a result, the stop loss order will save you from huge losses when a position takes an unfavorable direction.

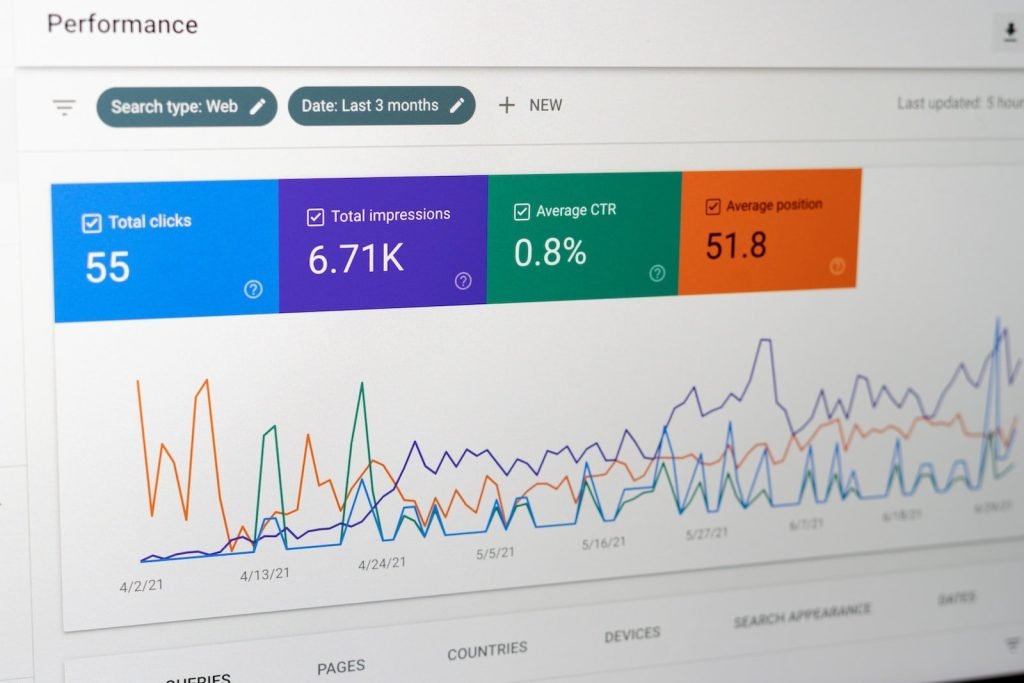

3. Not doing a thorough technical market analysis

Since market trends change from time to time in the crypto sphere, you will have to conduct fresh technical analysis frequently before taking a position. Crypto stock prices can vary for as short as one hour.

Therefore, before taking a risk, take your time to study current market activity, price movements, and other factors that could affect the price of a currency. That way, you will minimize the chances of making wrong trading decisions.

If you do not trust your analytical power, use price-tracking websites like Coinmarketcap to track price changes of all crypto coins

4. Trading without a detailed plan

Without a trading plan, you will hardly succeed in crypto trading. The plan helps you identify the crypto coins you will focus on, the rules that will govern your trading journey, and the conditions under which you will buy/sell.

It will keep you disciplined when trading. With it, you will have fewer chances of trading on impulse. Furthermore, a trading plan will help you track your trading progress and make necessary adjustments to remain productive.

5. Steer clear from revenge trade

Losses are inescapable in cryptocurrency trading. Even the most seasoned crypto trading expert will incur losses at one point. However, that should not scare you from this potentially lucrative.

When you incur a loss, do not revenge-trade. Why? That would be a sure recipe for making another significant loss. Instead, analyze the market comprehensively, check the price trends on Coinmarketcap, and then use the information to find better trading opportunities.

6. Over-relying on herd instincts

Herd mentality is a common pitfall for first-time traders. You will find yourself following and relying on insights from self-proclaimed crypto traders on slack, twitter, medium, YouTube, Facebook, and other digital platforms.

While trading tips from these peers can sometimes work, over-relying on them would be suicidal. The ‘pros’ will expose you to panic buying or selling, alongside crippling your ability to make independent trading decisions.

Instead of working with herd instincts, do your research and trade independently. You wouldn’t want to remain a layman forever.

7. Spending what you cannot afford to lose

Crypto trading will not always lead to profits. At times, market forces will change in no time, and you will lose a fortune. This happens even to the most experienced trader. This is why experts suggest investing in what you can afford to lose.

In the event of a loss, you will not sink into depression. As well, spending what you can lose will shield your financial health. You won’t find it hard to pay bills because your trading never went according to plans.

Take Away

As much as cryptocurrency trading is rewarding, a simple mistake will cost you a lot. For that reason, before you start dealing in this sphere, make sure you seal all potential pitfalls. Before starting trading, use a demo account to familiarize yourself with the trading process.

Afterward, make a comprehensive plan to guide your decisions, use the stop loss function to control risks, and do a thorough market analysis using tools like Coinmarketcap before taking a position. While you can follow advice from experts, use your rational power to make trading decisions.